The ultimate expat guide to getting health insurance in Saudi Arabia

A simple, stress-free breakdown of everything expats need to know about getting health insurance in Saudi Arabia

Navigating health insurance as an expat doesn’t have to be confusing.

If you’re one of the more than 13 million expats in Saudi Arabia, making up around 40 per cent of the total population, understanding your healthcare rights is essential. Medical care in the Kingdom is generally excellent, and you will find many English-speaking doctors and nurses, especially in private facilities.

Whether you’ve just landed in Saudi Arabia or you’re finally getting around to sorting out your coverage, this guide walks you through the essentials – minus the jargon. Here’s how the Saudi system works for foreigners and what your employer must provide.

Mandatory coverage

Free healthcare in Saudi Arabia applies only to Saudi nationals, so expats here depend on private hospitals. The upside? Your employer must legally cover you and your family with group health insurance, and they can’t deduct the premiums from your salary.

The basic benefits checklist

The Insurance Authority mandates that a basic health plan must include:

- Basic dental treatments, including fillings and cleaning, up to a specified monetary amount;

- Mental health treatments up to a specified limit;

- Maternity and delivery costs; as well as

- Vaccinations and necessary medicines.

It is legally required for employers to provide group health insurance for you and your dependents. They’re also prohibited from deducting any premium costs from your salary. This basic health coverage helps reduce your medical expenses and acts as a financial safety net during emergencies.

Decoding the healthcare landscape in Saudi Arabia

Regulated by the government’s Ministry of Health, the healthcare system in Saudi Arabia is well-established.

Public vs Private:

About one-third of hospitals in Saudi Arabia are privately operated. While many public hospitals have English-speaking staff, private hospitals tend to have even more. Always keep your health insurance card handy; it’ll make visiting private facilities a breeze.

Access Points:

- Primary Healthcare Centres (PHCs) – Think of these as your go-to for basic healthcare, from check-ups and screenings to vaccinations and general health advice.

- General Hospitals – For more serious health issues, head to a general hospital. They offer everything from emergency care and specialist diagnostics and treatment to surgeries and inpatient services. There are also specialist hospitals dedicated to specific conditions, making specialised care easier to access.

High-value benefits

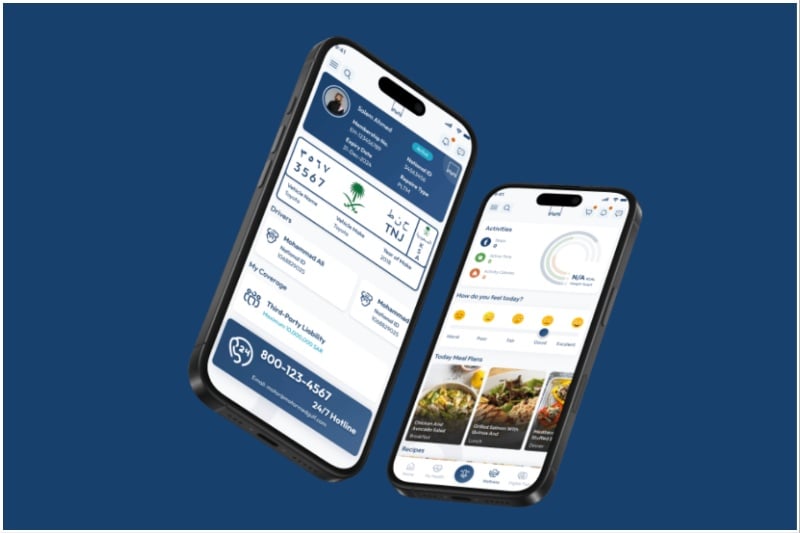

While basic coverage is mandatory by law, many employers do go above and beyond by offering upgraded plans. If your company opts for enhanced benefits, such as those available through the Salem Program via the MEDGULF app, you and your family can access the following specialised services.

- Dedicated support: Help from a dedicated hospital delegate, including VIP services and special assistance for hearing-impaired members.

- Chronic care management: A best-in-class chronic disease management program that includes consultations, refill notifications, and automated health refills. Medication can also be delivered within 24 hours.

- Family convenience: Home vaccinations for children up to the age of 7 at a convenient date and time. Special services are also offered for expectant mothers.

- Easy consultations: Quick and simple ways to consult doctors, either by phone or live chat.

- Specialist review: Access to second opinions if needed.

Accessing and calculating your costs

Employees must review the documents carefully, as corporate group health insurance plans vary significantly. Many employers utilise co-payment policies, which means you will pay a small portion of your medical bills yourself.

The easiest way to check your benefits and coverage limits is to download your policy information from your insurer’s app or website. From there, you can:

- See which hospitals you can visit;

- Check if specialised services, like dental or optical care, are included;

- View your co-payment obligations and coverage limits; and

- Calculate the cost of various medical treatments.

Key health facts

- Ambulance: Need an ambulance and/or paramedic services? Dial 997 – it’s free for everyone in Saudi Arabia. Once you’re admitted to the hospital, your health insurance takes care of the treatment costs.

- Dental care: As an expat, you must use a private dentist. So, be sure to check your policy to see how much you will need to pay towards dental care.

- Policy clarification: If you need further clarification, contact your employer’s HR department or your insurance provider for guidance.

How your employer sets up your health policy (and why it matters to you)

Understanding how your health insurance works helps you know what to expect, who to contact, and when your benefits start. Behind the scenes, your employer and insurer go through an established process to ensure everything is set up smoothly and that your coverage is active and ready whenever you need it.

Here’s a step-by-step guide to implementing your health insurance policy.

Step 1: Setting up your network access

Your company’s HR team collaborates with the insurer to develop a comprehensive understanding of your needs. They identify the preferred network of medical providers that can meet your company’s expectations for quality and accessibility. If you are a remote employee, they explore options that provide you with access to primary healthcare facilities near your location.

Step 2: Smooth registration

Your HR team provides your personal and dependent records to the insurer. The insurer manages the complex regulatory paperwork. The best ones ensure the process is smooth and efficient, with minimal administrative delays and quick enrolment.

Step 3: Tailoring your coverage

The insurer creates a customised plan that includes essential benefits such as maternity, mental health treatment, and basic dental care. This step verifies your coverage level (often aligning with different employee tiers).

Step 4: Finalising the details

Your company leadership works with the insurer to fine-tune the package. They ensure that the final plan is cost-effective and comprehensive, including all necessary essential benefits (such as chronic condition coverage) before signing off.

Step 5: Activation day

This is when your insurance officially starts. The insurer quickly processes the contracts and ensures a smooth activation of your upgraded medical coverage. Your policy is now officially in effect.

Step 6: Learning your benefits

You will be invited to onboarding sessions. These sessions give clear instructions on accessing medical services, understanding your benefits, and navigating the claims process. You will also be introduced to the mobile app for easy management of your health insurance.

Step 7: Dedicated long-term support

Health insurance requires a long-term commitment. Once the policy is in place, the insurer remains a dependable partner to your company, providing dedicated support for claims and complex cases. This ongoing partnership ensures your coverage remains up to date and effective.

Remember, your employee health insurance covers your medical expenses and provides the necessary financial support in emergencies. If you need clarification about your policy or costs, speak to your employer’s HR department or your insurance provider.

Images: Social / Unsplash